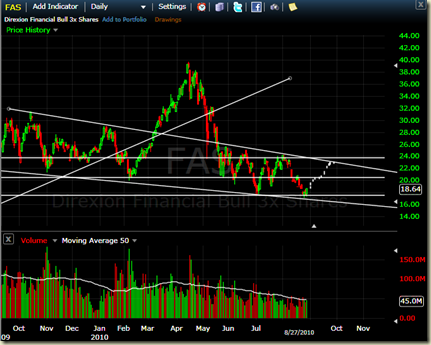

Looking at the FAS etf, Financials may be set for a bullish rally.

Lately, stocks have been trading on technical levels as the recovery has slowed down and the economy is at a standstill. Stocks should continue to trade rangebound until new indicators suggest otherwise.

The next resistance on FAS is $20.5, and it may easily break that resistance as FAS is known to smash through the first resistance 4 times out of the last 4 previous rally. The 2nd resistance is $23, which is our TP level.

One can trade the FAS to realize gains in BAC and WFC.

Otherwise, the good banking stocks to buy now are BAC, WFC, JPM.

Next week indicators will result in a volatile trading week. Currently, market direction is upwards again since the crazy rally last Friday. The market has been wanting to go up since last Wednesday, and Friday’s action has convinced traders that investors are buying in.

More things to note are that FUNDS are collecting new money, so there will be inflow of money into stocks.

The most important indicator next week is the ADP employment, as it provides us with a gauge of the NFP report. Currently, analysts are hoping for an increase in private sector jobs by 20k. Any number that is positive should provide a boost to the currently weakened market.

Chances of a double dip has increased, but many smart ppl except one notable DR DOOM, have cast away doubts about the double dip scenario based on their experience.

For now, FAS will definitely help to boost financials stocks.

I forgot to add Citigroup too.

No comments:

Post a Comment