I have to admit that I don’t understand how CRM is valued. It is trading at 200X PE!!!! What the?

My DCF workings gave me only $25 target price. I checked through a few times to see where I might be wrong, and I even used the same values as most brokers reports but it didnt help. Why is Salesforce overvalued? What is the basis? Based on brokers reports, there is little growth… they are expecting only 20% revenue growth.

The stock is trading at $130 and the DCF shows $25… I am missing something big.

Please help me check my workings. If everything is right, it looks like we’ve got a winner short here. But don’t act on it just yet. Wait for the hype. It could take 2 weeks. And we surely have to do more due diligence and checks. Salesforce is complicated.

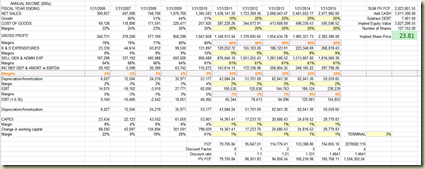

I have shared my DCF workings on google spreadsheet again, anyone can edit it and try to get the implied share price up to its current value of $130….

You can only change the yellow boxes to make sense. And remember to put %.

Here’s the screenshot in case the file goes awry.

Also, I have made working capital changes and CAPEX ultra low to help raise the valuation…

Leave some comments below to tell me what went wrong in this DCF.

3 comments:

I made some changes for you. Accelerated growth and improved operating margins in the future. Also made some adjustments to D&A schedule and working capital. This is a negative working capital business because customers pay up front, so cash flow is better.

Number of shares is wrong, diluted they are close to 140 milion. Debt is wrong, it's higher.

And "Anonymous" above inputed some quite irrealistic numbers into the spreadsheet to make it look better, like a huge acceleration of growth and huge margins that CRM never saw and there's no reason to believe will ever see, while retailing CRM software and selling computer space, a notorious low margin business.

Even with those irrealistic numbers, just correcting the number of shares and debt would throw the share price back to $90 or so ... funny. Not even outrageous numbers justify the price or anything like it - CRM will fall at least 505 in the next 2 years.

(fall at least 50%)

Post a Comment