Stocks are for the 4th time trading higher on poor economic data. This is solely due to dollar decline and QE talks. This is going to be an unstable bubble that may burst when the economy just keeps deteriorating.

Currently, stocks enjoy both good and bad news. They go up no matter what. So there are only 2 take away here.

1. Hold the rally, and sell into it.

2. Miss the boat or wait for a correction.

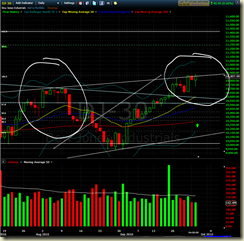

This is a scary level to start going long on equities. We have already broken one resistance line, and it will be crazy to break the next resistance line without any correction. Amid all this poor economic data, investors flee safety and are looking for risk assets as they trust that the FED will artificially inflate all these risky assets.

However, look a few months back, the candle patterns are looking almost the same. We might be seeing a real and sharp reversal. This is just a thought.

The CB confidence failed to break up the rally. What will? Are we really in a bull rally that will only end next year? Stocks will not keep climbing up. I think the market is still deeply overbought. And there will be a sharp but minor correction.

No comments:

Post a Comment