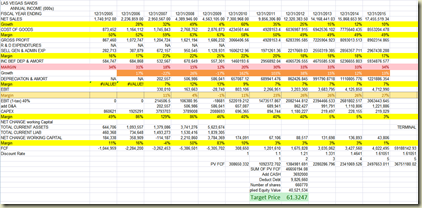

Here is LVS DCF valuation.

SCENARIO 1 (Little growth left) TP $50

I projected 2011 growth at 30% mainly due to the fully opened Singapore Property,

I projected 12% growth for the remaining years until its terminal stage.

SCENARIO 2 (EXPANDING GROWTH DUE TO COTAI PROJECT)

TARGET: $61

In this case, I projected 2011 growth at 40% due to Cotai opening, and 2012 growth at 25% due to Cotai again, and remaining growth at 15% and 12% till terminal stage.

SCENARIO 3 (SINGAPORE TIGHTENING + Little Growth and OVERSUPPLY in MACAU)

TARGET: $25

Here, I projected 2011 growth at only 10% due to las vegas growth, but slow to little growth in its Singapore property and little growth in Macau.

I increase the margins due to higher expenses related to the oversupply in Macau.

CONCLUSION: LVS is a high risk play now. SHORT at $65 is my best trade idea for LVS.

SELL $70 calls, BUY $30 PUTS might also be a good OPTION play.

No comments:

Post a Comment